Accelerate Your Growth: The Secrets to Successful Scaling

July 2, 2024Discover the key strategies and tactics used by top entrepreneurs to effectively scale their businesses and achieve rapid growth.

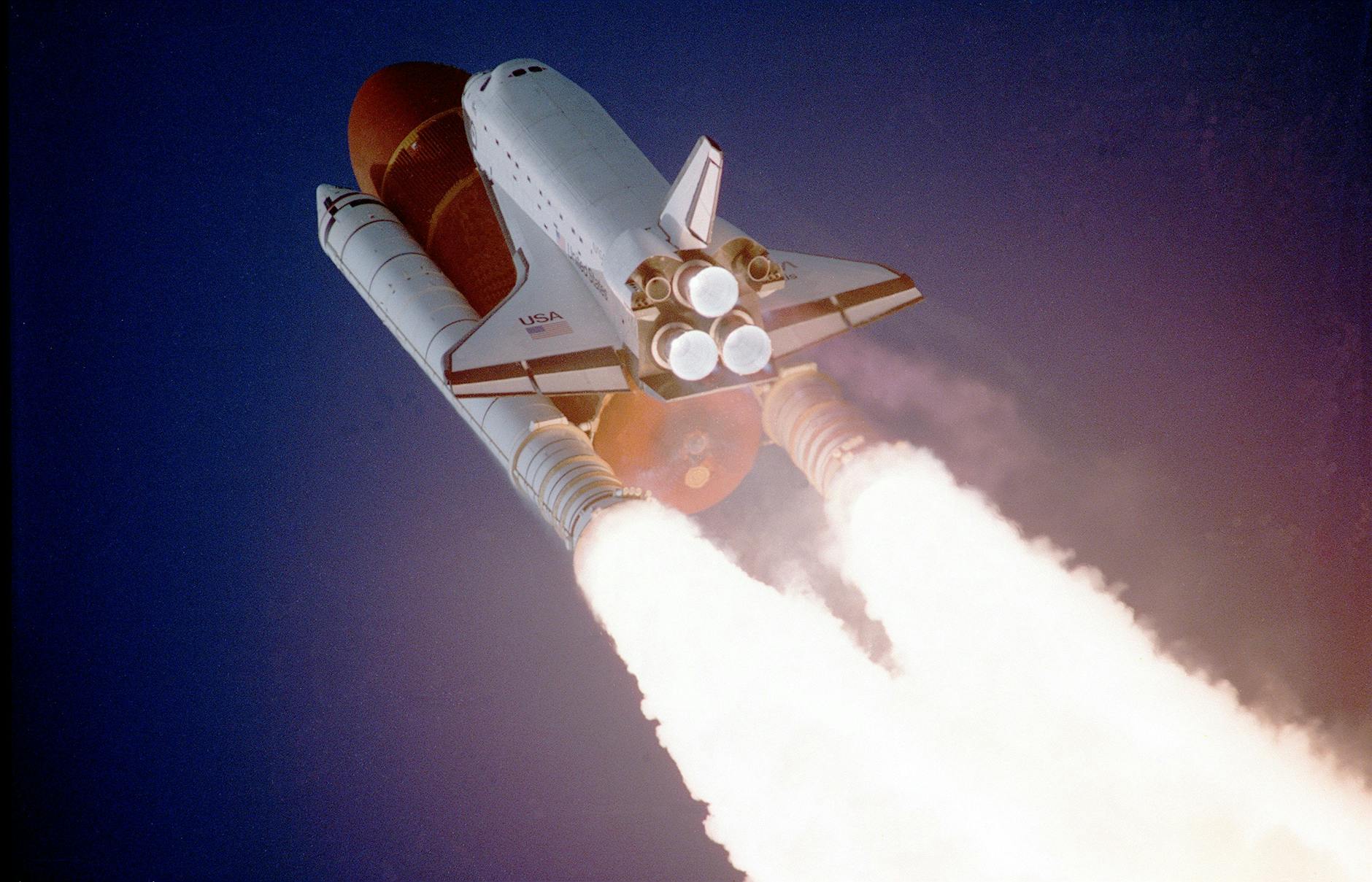

Image courtesy of Pixabay via Pexels

Table of Contents

Running a successful business involves more than just offering a great product or service. It also requires effective management of finances. Without proper financial management, even the most promising businesses can quickly find themselves in trouble. In this blog post, we will discuss the key steps to managing your business finances effectively to ensure long-term success.

Establishing a Budget

Creating a budget is the first step in managing your business finances effectively. Start by determining your monthly income and expenses. This will give you a clear picture of where your money is coming from and where it’s going. Allocate funds to cover essential expenses such as payroll, rent, utilities, and supplies. It’s also important to set aside money for savings and unexpected expenses.

Tracking Expenses

Keeping detailed records of all business expenses is crucial for effective financial management. Use accounting software or spreadsheets to track transactions and categorize expenses. Regularly review your expenses to identify areas where costs can be reduced. By understanding where your money is going, you can make informed decisions about how to better allocate your resources.

Monitoring Cash Flow

Maintaining a positive cash flow is essential for the health of your business. This means ensuring that your revenue exceeds your expenses. Anticipate any seasonal fluctuations in cash flow and plan accordingly. Use cash flow projections to identify potential cash shortages and take proactive steps to address them. By staying on top of your cash flow, you can avoid financial pitfalls and keep your business running smoothly.

Managing Debt

Debt can be a useful tool for growing your business, but it can also quickly become a burden if not managed properly. Avoid taking on unnecessary debt and develop a repayment plan for existing debts. Consider negotiating with creditors to lower interest rates or extend payment terms if needed. By managing your debt effectively, you can minimize financial stress and keep your business on solid financial footing.

Seeking Professional Help

Managing your business finances can be complex, especially as your business grows. Consider hiring a financial advisor or accountant to help with financial planning. They can provide valuable insights and expertise to help you make informed decisions about your finances. Additionally, attend workshops or seminars on financial management to expand your knowledge and skills. There are also many online resources and tools available to enhance your financial literacy and support your business growth.

Conclusion

Effective financial management is essential for the success of any business. By establishing a budget, tracking expenses, monitoring cash flow, managing debt, and seeking professional help, you can ensure that your business remains financially healthy and continues to grow. Take proactive steps to manage your business finances effectively and invest in the long-term success of your business. By prioritizing financial management, you can accelerate your growth and achieve your business goals.