From Start-Up to Success: How These Entrepreneurs Built Thriving Businesses

June 16, 2024Discover the surprising strategies these entrepreneurs used to build their successful businesses from the ground up. Learn their secrets now!

Image courtesy of jose luis Umana via Pexels

Table of Contents

Financial planning is a critical aspect of running a successful small business. It involves setting clear goals, creating a budget, managing cash flow, investing for growth, and monitoring financial performance. In this ultimate guide, we will explore the key steps involved in financial planning for small businesses.

Setting Financial Goals

Setting financial goals is the first step in any financial planning process. Entrepreneurs need to identify both short-term and long-term goals that align with their business objectives. Using the SMART goal-setting framework can help ensure that goals are specific, measurable, achievable, relevant, and time-bound.

Creating a Budget

A budget is a roadmap for how a small business plans to allocate its financial resources. By tracking expenses and income, business owners can make informed decisions about where to allocate funds. It is crucial to establish financial priorities and allocate funds to different business needs accordingly.

Managing Cash Flow

Effective cash flow management is essential for the survival and growth of a small business. By monitoring cash flow regularly, entrepreneurs can identify potential cash shortages and take proactive steps to address them. Utilizing financial tools such as cash flow statements can help business owners stay on top of their finances.

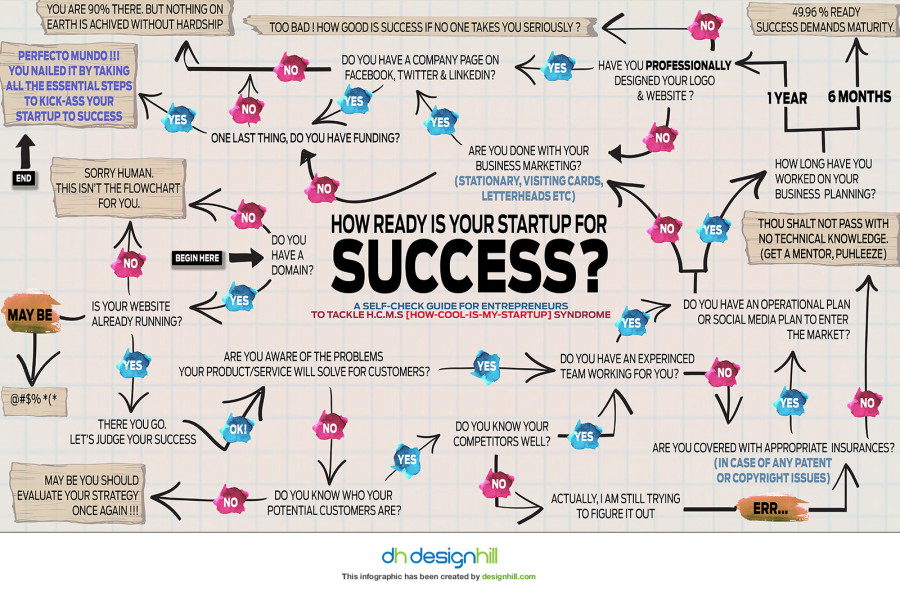

Image courtesy of www.business2community.com via Google Images

Investing for Growth

Investing in business growth is a key strategy for long-term success. Small business owners need to assess the different types of investments available to them, such as marketing initiatives, technology upgrades, or new product development. It is also essential to consider risk management factors when making investment decisions.

Monitoring and Evaluating Financial Performance

Tracking key financial metrics is crucial for evaluating the financial health of a small business. Business owners should regularly conduct financial analysis to assess their performance against their goals and make any necessary adjustments to their financial plan. It is essential to adapt to changing market conditions and business needs.

In conclusion, financial planning is a foundational element of running a successful small business. By setting clear financial goals, creating a budget, managing cash flow, investing for growth, and monitoring financial performance, entrepreneurs can position their businesses for long-term success. Regularly reviewing and updating the financial plan is crucial to ensure that the business remains on track to achieve its objectives.