Bucks and Benefits: Maximizing Your Financial Potential

June 14, 2024Unlock the secrets to maximizing your financial potential with strategic bucks and benefits planning that will transform your future.

Image courtesy of Pixabay via Pexels

Table of Contents

Running a successful business involves much more than just providing a great product or service. Understanding the ins and outs of finance is crucial for business owners to make informed decisions and ensure long-term stability. In this blog post, we will explore the basics of finance for business owners, covering topics such as financial statements, budgeting, cash flow management, investment options, financing, and risk management.

Understanding Financial Statements

Financial statements are essential tools that provide insights into a business’s financial health and performance. The three main types of financial statements are the income statement, balance sheet, and cash flow statement.

The income statement, also known as the profit and loss statement, shows a business’s revenue and expenses over a specific period. Analyzing this statement can help business owners identify trends, assess profitability, and make informed decisions about pricing and cost management.

The balance sheet provides a snapshot of a business’s assets, liabilities, and equity at a specific point in time. It is crucial for understanding the overall financial position of a business and its ability to meet its financial obligations.

The cash flow statement tracks the flow of cash into and out of a business over a specific period. Managing cash flow is essential for ensuring that a business has enough liquidity to cover its operating expenses and invest in growth opportunities.

Budgeting and Forecasting

Creating a budget and financial forecast is essential for business owners to plan and monitor their financial performance. A budget outlines expected revenues and expenses for a specific period, helping business owners allocate resources effectively and track progress towards financial goals.

Financial forecasting involves predicting future financial outcomes based on historical data and future projections. By creating realistic financial forecasts, business owners can anticipate potential challenges and opportunities, allowing them to make proactive decisions to safeguard their business’s financial health.

Managing Cash Flow

Effective cash flow management is critical for business sustainability. Business owners must monitor and control the inflow and outflow of cash to ensure that there is enough liquidity to cover expenses and invest in growth opportunities.

Image courtesy of www.linkedin.com via Google Images

Strategies for improving cash flow include managing accounts receivable to ensure timely payments from customers and negotiating favorable terms with suppliers to optimize accounts payable. Additionally, maintaining a cash reserve and implementing cost-cutting measures during lean periods can help businesses weather financial challenges.

Investment and Financing Options

Business owners have a variety of investment options available to grow their wealth and diversify their financial portfolios. Common investment options include stocks, bonds, real estate, and other financial instruments. It is essential for business owners to assess their risk tolerance and investment goals before making investment decisions.

When it comes to financing, business owners can choose from a range of options, including bank loans, venture capital, angel investors, and crowdfunding. Each financing option has its pros and cons, and business owners must carefully evaluate their financing needs and objectives before selecting the most suitable option.

Risk Management

Identifying and managing financial risks is crucial for protecting a business’s assets and ensuring long-term viability. Business owners must assess risks related to market volatility, regulatory changes, cybersecurity threats, and other external factors that could impact their business.

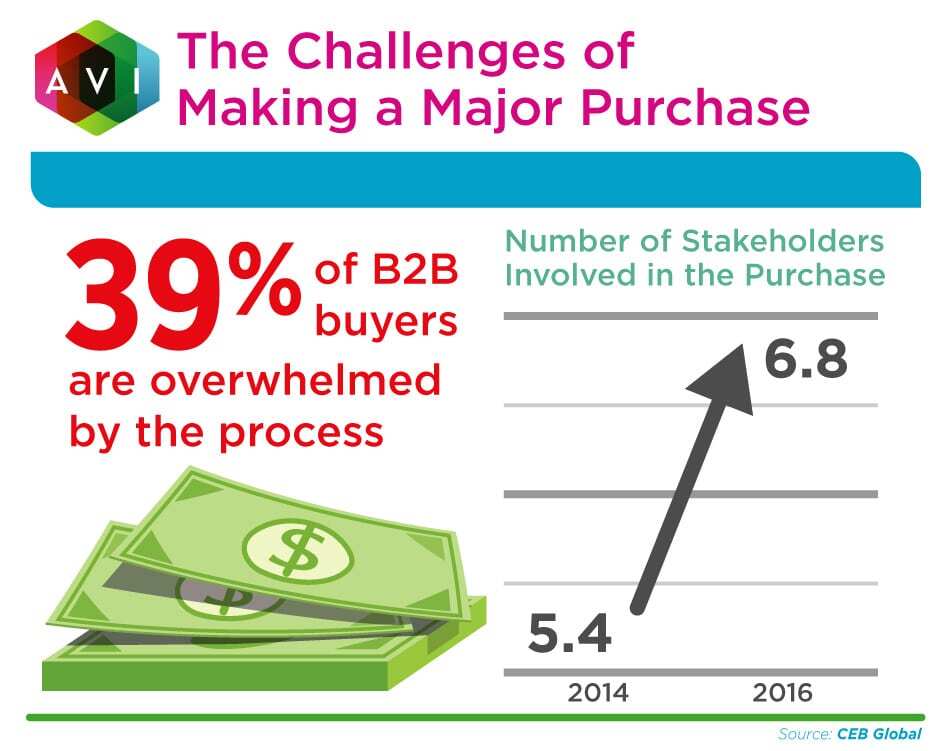

Image courtesy of www.avisystems.com via Google Images

Strategies for risk management include purchasing insurance coverage to mitigate potential losses, diversifying investment portfolios to reduce exposure to specific risks, and implementing robust internal controls to prevent fraud and financial mismanagement.

Conclusion

Understanding the basics of finance is essential for business owners to make informed decisions, manage financial resources effectively, and ensure the long-term success of their businesses. By mastering concepts such as financial statements, budgeting, cash flow management, investment options, financing, and risk management, business owners can maximize their financial potential and achieve their business goals.

Remember, financial literacy is a continuous learning process, and business owners should seek professional advice and guidance when needed to navigate complex financial matters and make sound financial decisions. By prioritizing financial education and taking proactive steps to manage their finances, business owners can build a solid financial foundation for their businesses and secure a bright financial future.