The Ultimate Guide to Building a Successful Startup

June 6, 2024Unlocking the secrets to launching a successful startup – from funding to branding, this guide has everything you need to know.

Image courtesy of JESHOOTS.com via Pexels

Table of Contents

Starting a business can be an exciting and rewarding endeavor, but managing finances effectively is crucial to the success of any startup. In this guide, we will walk you through the steps to manage your business finances like a pro.

Establish a Budget

Before diving into the world of business finances, it’s essential to establish a budget that aligns with your goals and objectives. Start by defining your business goals and financial objectives. Are you looking to increase revenue, expand your product offerings, or improve overall profitability?

Next, determine your revenue sources and expenses. This includes identifying fixed costs like rent, utilities, and salaries, as well as variable costs such as marketing expenses and inventory purchases. Create a detailed budget that outlines all of your expenses and projected revenue streams.

Track Income and Expenses

Once you have established a budget, it’s crucial to track all income and expenses accurately. Set up a system to record and categorize your financial transactions, whether it’s through accounting software, spreadsheets, or a manual ledger.

Regularly review financial statements and reports to monitor your cash flow. This will help you identify any potential issues or areas where you can cut costs or increase revenue. Keeping organized records will also be beneficial for tax purposes and financial planning.

Monitor Cash Flow

Cash flow management is a critical aspect of running a successful business. Understand your cash flow cycle and be aware of peak and slow periods. This will help you plan for fluctuations in revenue and expenses.

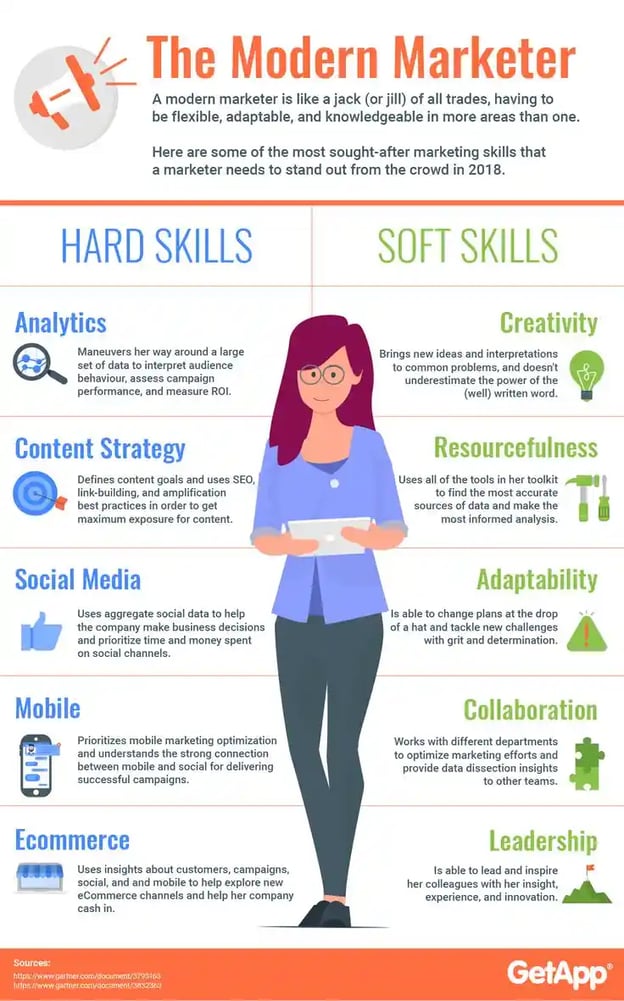

Image courtesy of piktochart.com via Google Images

Implement strategies to improve cash flow, such as accelerating receivables by offering discounts for early payments or reducing expenses by renegotiating contracts with suppliers. It’s also essential to set aside an emergency fund for unexpected expenses or cash flow gaps to ensure the financial stability of your business.

Plan for Taxes

Staying on top of your tax obligations is essential for any business owner. Stay informed about tax laws and regulations that may affect your business, and work with a tax professional to maximize deductions and credits.

Set aside funds for quarterly estimated tax payments or tax liabilities at year-end to avoid any surprises. Planning for taxes in advance will help you manage your cash flow effectively and prevent any potential financial setbacks.

Seek Professional Help

Managing business finances can be complex, especially for new entrepreneurs. Consider hiring a financial advisor or accountant to provide guidance and support. These professionals can help you navigate the complexities of business finances and develop strategies to achieve your financial goals.

Image courtesy of blog.hubspot.com via Google Images

Attend workshops or seek out resources to improve your financial literacy. Collaborate with other business owners or mentors for insights and advice on financial management. Building a network of support and knowledge-sharing can be invaluable as you grow your business.

Conclusion

Managing your business finances effectively is essential for the success and sustainability of your startup. By establishing a budget, tracking income and expenses, monitoring cash flow, planning for taxes, and seeking professional help, you can take control of your finances and set your business up for long-term success.

Implement the tips and strategies mentioned in this guide to enhance your financial management skills and build a solid foundation for your startup’s growth. With a proactive approach to managing your finances, you can navigate the challenges of entrepreneurship with confidence and achieve your business goals.