Money Moves: How to Grow Your Wealth and Reach Your Goals

June 5, 2024Discover the top secrets to financial success and learn how to make strategic money moves to achieve your wealth goals.

Image courtesy of maitree rimthong via Pexels

Table of Contents

Business finance is a critical aspect of running a successful company. It involves managing the funds and resources within an organization to achieve its financial goals. Having a solid understanding of business finance is essential for making informed decisions, planning for growth, and ensuring the sustainability of the business.

Types of Business Finance

There are several types of business finance that companies can utilize to fund their operations and projects. These include equity financing, debt financing, internal financing, short-term financing, and long-term financing.

Equity financing involves raising capital by selling shares of ownership in the company. This can be done through private investors, venture capitalists, or by going public through an initial public offering (IPO).

Debt financing, on the other hand, involves borrowing money from lenders or financial institutions and repaying it over time with interest. This can include loans, lines of credit, or bonds.

Internal financing refers to using the company’s own profits and resources to fund its operations and investments. This can include reinvesting profits, selling assets, or reducing expenses to generate cash flow.

Short-term financing is used to meet the company’s immediate cash needs, such as covering payroll or purchasing inventory. This can include trade credit, invoice financing, or short-term loans.

Long-term financing is used to fund larger investments and projects that require a longer repayment period. This can include mortgages, equipment financing, or long-term loans.

Financial Statements

Financial statements are essential documents that provide a snapshot of a company’s financial performance and position. The three main financial statements include the income statement, balance sheet, and cash flow statement.

The income statement shows the company’s revenues, expenses, and net income over a specific period. It helps stakeholders understand the profitability of the business and its ability to generate income.

The balance sheet provides a summary of the company’s assets, liabilities, and equity at a specific point in time. It shows the company’s financial position and helps stakeholders assess its solvency and liquidity.

The cash flow statement tracks the inflows and outflows of cash within the company. It shows how cash is generated and used in operating, investing, and financing activities. This statement is crucial for assessing the company’s ability to meet its financial obligations.

Analyzing financial statements can help stakeholders make informed decisions, identify trends, and assess the financial health of the business.

Financial Ratios

Financial ratios are tools used to evaluate a company’s financial performance and position. There are several categories of financial ratios, including liquidity ratios, profitability ratios, efficiency ratios, and solvency ratios.

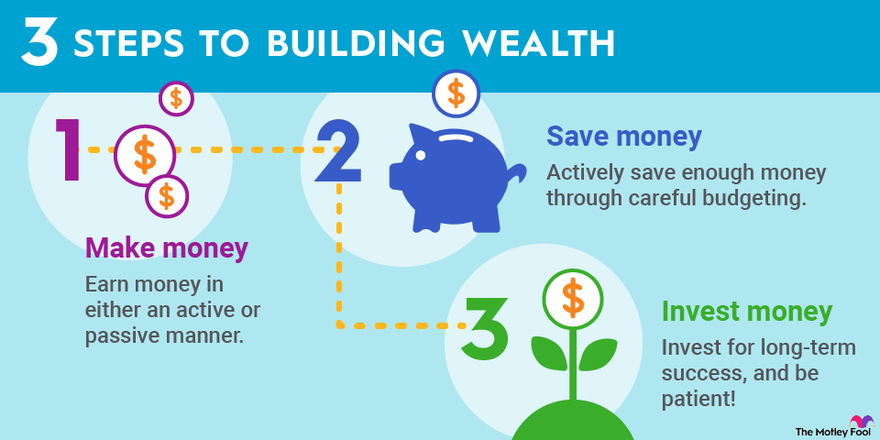

Image courtesy of www.fool.com via Google Images

Liquidity ratios measure the company’s ability to meet its short-term obligations using its current assets. Examples include the current ratio and quick ratio.

Profitability ratios assess the company’s ability to generate profit from its operations. Examples include the gross profit margin, net profit margin, and return on equity.

Efficiency ratios evaluate how well the company utilizes its assets and resources to generate revenue. Examples include the asset turnover ratio and inventory turnover ratio.

Solvency ratios measure the company’s ability to meet its long-term obligations using its assets. Examples include the debt-to-equity ratio and interest coverage ratio.

By analyzing financial ratios, stakeholders can gain insights into the company’s financial performance, compare it to industry benchmarks, and identify areas for improvement.

Budgeting and Forecasting

Budgeting and forecasting are essential tools for planning and managing the financial resources of a business. Budgeting involves setting financial goals, allocating resources, and monitoring performance against targets.

There are different types of budgets that companies can use, such as operating budgets, capital budgets, and cash budgets. Each type serves a specific purpose and helps the company achieve its financial objectives.

Forecasting techniques, such as trend analysis, regression analysis, and scenario analysis, help companies predict future financial outcomes and plan accordingly. By forecasting revenues, expenses, and cash flows, companies can make informed decisions and mitigate risks.

Effective budgeting and forecasting can help companies optimize their financial resources, improve decision-making, and achieve their financial goals.

Financial Management

Financial management involves managing the company’s financial resources to achieve its objectives and maximize shareholder value. This includes managing cash flow, making investment decisions, controlling costs, and managing risks.

Image courtesy of www.thewealthquay.com.au via Google Images

Managing cash flow is crucial for ensuring the company has enough liquidity to meet its financial obligations. This involves monitoring cash inflows and outflows, managing working capital, and optimizing cash reserves.

Making investment decisions involves evaluating investment opportunities, assessing risks and returns, and selecting projects that align with the company’s strategic goals. This can include investments in new products, technologies, or markets.

Cost control strategies help companies reduce expenses, improve efficiency, and maximize profits. This can include reducing waste, negotiating better contracts, or implementing cost-saving measures.

Risk management in business finance involves identifying, assessing, and mitigating risks that could impact the company’s financial performance. This can include market risks, credit risks, operational risks, and regulatory risks.

By implementing effective financial management practices, companies can optimize their financial performance, achieve their objectives, and create long-term value for stakeholders.

Conclusion

Understanding the basics of business finance is essential for running a successful company. By mastering concepts such as types of business finance, financial statements, financial ratios, budgeting and forecasting, and financial management, companies can make informed decisions, plan for growth, and ensure financial sustainability.

Continuous learning and improvement in business finance are key to staying competitive in today’s dynamic business environment. By applying best practices and leveraging financial tools and techniques, companies can navigate challenges, seize opportunities, and achieve their financial goals.