How to Build Wealth: A Step-by-Step Guide to Financial Freedom

June 4, 2024Unlock the secrets to building wealth and achieving financial freedom with this step-by-step guide that will change your life.

Image courtesy of Pille Kirsi via Pexels

Table of Contents

Small business owners face a myriad of challenges when it comes to managing their finances. From budgeting and cash flow management to tax planning and long-term financial strategies, the key to success lies in understanding and implementing essential finance tips. In this blog post, we will explore some crucial steps that small business owners can take to ensure financial stability and growth.

Budgeting Basics

Creating a budget is the foundation of sound financial management for small businesses. It allows you to set realistic financial goals, track your expenses, and make informed decisions about where to allocate resources. To create an effective budget, start by identifying your fixed costs, such as rent and utilities, and variable expenses, such as inventory or marketing. Utilize budgeting tools or software to help streamline the process and keep you on track.

Cash Flow Management

Cash flow is the lifeblood of any business, and proper management is essential for long-term sustainability. To effectively manage cash flow, consider implementing strategies such as invoice tracking, negotiating payment terms with vendors, and maintaining a cash reserve for emergencies. By monitoring your cash flow regularly and addressing any cash flow gaps proactively, you can prevent financial stress and keep your business operations running smoothly.

Tax Planning

Tax planning is a critical aspect of financial management for small business owners. Understanding the tax implications of your business structure and industry can help you maximize deductions and credits while staying compliant with tax laws. Consider working with a tax professional to develop a tax strategy that aligns with your business goals and minimizes your tax liability. By staying organized and proactive with your tax planning, you can avoid costly mistakes and optimize your financial position.

Financing Options

When it comes to financing your small business, there are various options to consider, such as loans, lines of credit, and crowdfunding. Each financing option has its own pros and cons, so it’s essential to evaluate your business’s needs and financial situation carefully. Research different lenders and financing programs to find the best fit for your business. Whether you’re looking to fund a new project, expand your operations, or cover unexpected expenses, understanding your financing options is key to achieving your business objectives.

Long-Term Financial Planning

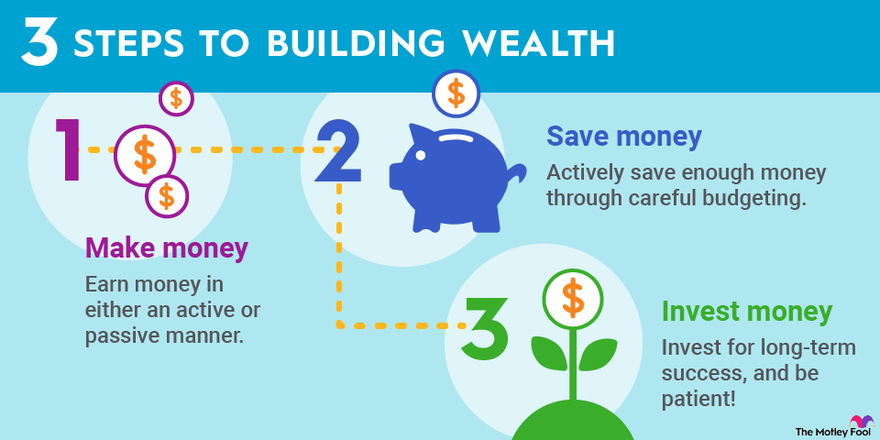

Long-term financial planning is crucial for building wealth and securing your financial future. As a small business owner, consider developing a comprehensive financial plan that addresses your retirement savings, investment strategies, and wealth management goals. Consult with a financial advisor to create a personalized plan that takes into account your business income, assets, and risk tolerance. By consistently reviewing and adjusting your long-term financial plan, you can build wealth over time and achieve financial freedom.

In conclusion, implementing essential finance tips can help small business owners navigate the complexities of financial management and achieve long-term success. By focusing on budgeting, cash flow management, tax planning, financing options, and long-term financial planning, you can build wealth, secure your financial future, and pave the way to financial freedom.