From Passion to Profit: Turning Your Hobby into a Successful Business

May 24, 2024Unleash the potential of your passion by transforming your hobby into a lucrative business venture – find out how here!

Image courtesy of Vlada Karpovich via Pexels

Table of Contents

Managing finances effectively is a crucial aspect of running a successful business. Regardless of the size or nature of your business, proper financial management can be the key to sustainable growth and long-term success. In this comprehensive guide, we will explore various strategies and tips to help you maximize your business finances.

Creating a Budget

Establishing a budget is the first step towards effective financial management in your business. A budget serves as a roadmap for your financial activities, helping you allocate resources efficiently and track your expenses. To create a realistic budget, start by analyzing your past financial data and forecasting your future expenses and revenues. Consider using budgeting tools and software to streamline the process and ensure accuracy.

Managing Cash Flow

Cash flow management is essential for the smooth operation of your business. Positive cash flow ensures that you have enough funds to cover your expenses and invest in growth opportunities. To maintain a healthy cash flow, monitor your cash flow regularly, delay payments when possible, and incentivize early payments from customers. In case of cash flow challenges, consider options such as securing a line of credit or negotiating payment terms with suppliers.

Investing Wisely

Investing excess capital in profitable ventures can help your business grow and expand. Before making any investment decisions, conduct thorough research and assess the potential risks and returns. Consider diversifying your investments to minimize risk and maximize returns. Keep in mind that all investments come with inherent risks, so it’s important to weigh the pros and cons carefully before making a decision.

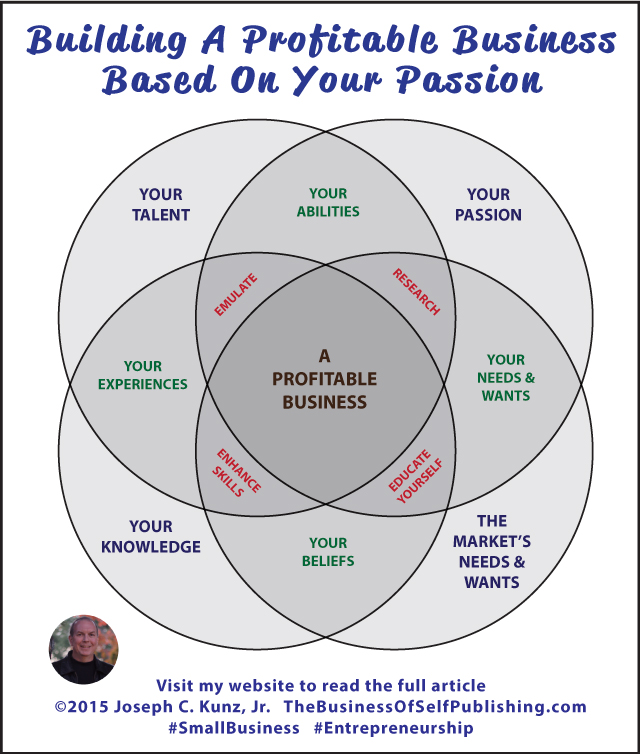

Image courtesy of kunzonpublishing.com via Google Images

Financial Reporting and Analysis

Accurate financial reporting is essential for making informed business decisions. Key financial statements such as the income statement, balance sheet, and cash flow statement provide valuable insights into your business performance. By analyzing these financial statements and utilizing financial ratios, you can gain a deeper understanding of your financial health and identify areas for improvement. Regularly review and analyze your financial reports to track your progress and make necessary adjustments.

Seeking Professional Guidance

At some point, you may consider seeking the expertise of a financial advisor or accountant to help you manage your business finances. Financial professionals can offer valuable insights and guidance on complex financial matters, such as tax planning, investment strategies, and financial analysis. When choosing a financial advisor, consider their qualifications, experience, and track record. Working with the right financial advisor can help you make sound financial decisions and achieve your business goals.

In conclusion, maximizing your business finances requires careful planning, monitoring, and strategic decision-making. By creating a budget, managing cash flow, investing wisely, analyzing financial reports, and seeking professional guidance, you can take control of your business finances and set the stage for long-term success. Remember that financial management is an ongoing process, so be proactive in reviewing and adjusting your financial strategies to adapt to changing market conditions and achieve your business objectives.