The Top 10 Business Trends to Watch in 2021

May 21, 2024Discover the latest business trends shaping the future in 2021. Are you ready for the changes ahead? Stay informed here!

Image courtesy of Arnesh Yadram via Pexels

Table of Contents

Managing finances effectively is crucial for the success and growth of any business. By establishing clear financial goals and implementing sound strategies, businesses can ensure long-term financial stability and profitability.

Establish Financial Goals

Before diving into financial management, it is essential to define both short-term and long-term financial goals for the business. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART).

Short-term goals may include increasing monthly revenue by a certain percentage or reducing operational expenses. Long-term goals could involve expanding into new markets or achieving a specific profit margin.

Create a Budget

One of the fundamental aspects of managing business finances is creating a budget. A budget helps businesses track and control their spending, ensuring that financial resources are allocated efficiently.

To create a budget, start by calculating the total income and expenses of the business. Then, allocate funds to different areas such as marketing, operations, and expansion. Regularly monitor and adjust the budget to stay on track with financial goals.

Monitor Cash Flow

Cash flow is the lifeblood of any business, and monitoring it is crucial for financial health. Keep track of the inflow and outflow of money in the business through a cash flow statement.

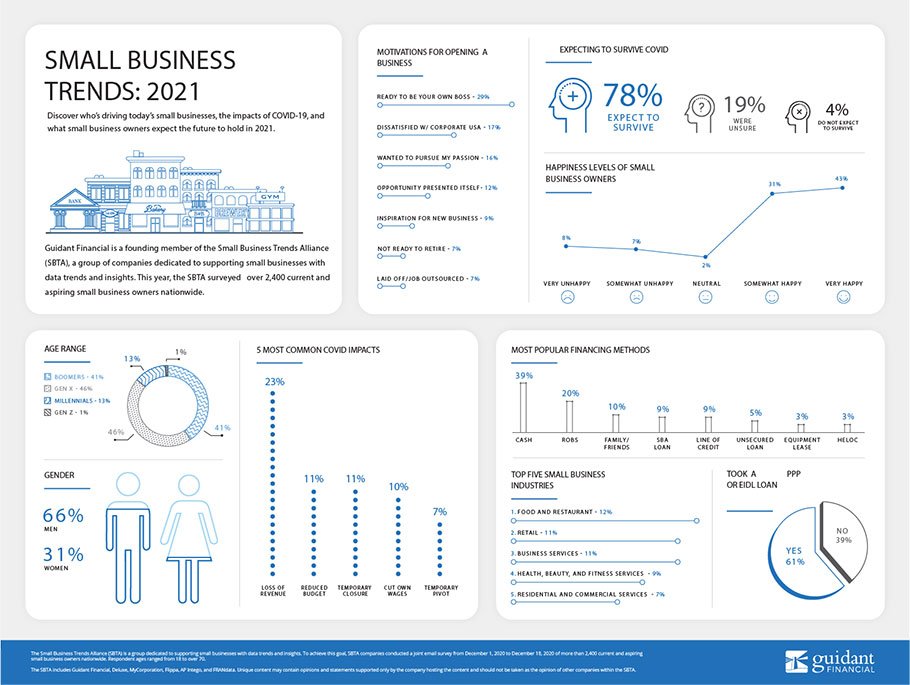

Image courtesy of www.guidantfinancial.com via Google Images

Identify any cash flow gaps or issues and take proactive measures to address them. Strategies to improve cash flow may include negotiating better payment terms with suppliers or offering discounts for early payments.

Invest Wisely

Once the business has surplus funds, it’s essential to invest them wisely to maximize returns. Research and compare investment opportunities to find the best options for the business.

Diversifying investments can help mitigate risk and ensure stability. Consider seeking advice from a financial advisor to make informed investment decisions that align with the business’s goals and risk tolerance.

Review and Adjust Financial Strategies

Financial management is an ongoing process that requires regular review and adjustment of strategies. Compare actual financial results to the budget and goals to identify areas for improvement.

Image courtesy of www.equipmentfinanceadvantage.org via Google Images

Be proactive in making adjustments to financial strategies to address any challenges or changes in the business environment. Continuously monitor and adapt financial practices to ensure the business’s long-term financial success.

Conclusion

Effective financial management is essential for the success and growth of any business. By establishing clear financial goals, creating a budget, monitoring cash flow, investing wisely, and reviewing and adjusting financial strategies, businesses can ensure long-term financial stability and profitability.

Implementing these strategies can help businesses navigate challenges, seize opportunities, and achieve their financial objectives. By prioritizing effective financial management, businesses can set themselves up for success in the competitive business landscape.