Investing 101: A Beginner’s Guide to Building Wealth

May 14, 2024Discover the secrets to growing your wealth from scratch with this essential guide to investing for beginners. Start now!

Image courtesy of maitree rimthong via Pexels

Table of Contents

Investing can be an intimidating concept, especially for beginners. However, with the right knowledge and strategy, it is possible to build wealth and secure your financial future through smart investment decisions. In this guide, we will walk you through the basics of investing, from understanding different investment options to creating a solid investment plan. By the end of this article, you will have the tools you need to start your journey towards financial success.

Understanding Different Investment Options

Before diving into the world of investing, it is essential to understand the different investment options available to you. Here are some of the most common types of investments:

Stocks: Stocks represent ownership in a company. By purchasing shares of a company’s stock, you become a partial owner of that company.

Bonds: Bonds are debt securities issued by governments or corporations. When you buy a bond, you are essentially lending money to the issuer in exchange for regular interest payments.

Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

Real Estate: Investing in real estate involves purchasing properties with the expectation of generating rental income or capital appreciation.

Creating a Solid Investment Plan

Once you have a basic understanding of the different investment options available, the next step is to create a solid investment plan. Here are some key steps to consider:

Set Clear Goals: Define your investment goals, whether it is saving for retirement, buying a house, or funding your children’s education. Your goals will help determine your investment strategy.

Assess Your Risk Tolerance: Understand your risk tolerance, or the amount of risk you are willing to take with your investments. Your risk tolerance will influence your asset allocation and investment choices.

Diversify Your Portfolio: Diversification is key to managing risk in your investment portfolio. By spreading your investments across different asset classes and industries, you can reduce the impact of a single investment’s performance on your overall portfolio.

Monitor and Rebalance: Regularly review your investment portfolio to ensure it aligns with your goals and risk tolerance. Rebalance your portfolio as needed to maintain your desired asset allocation.

Setting Realistic Expectations

It is important to set realistic expectations when it comes to investing. While investing can potentially help you build wealth over time, it is not a get-rich-quick scheme. Here are some key points to keep in mind:

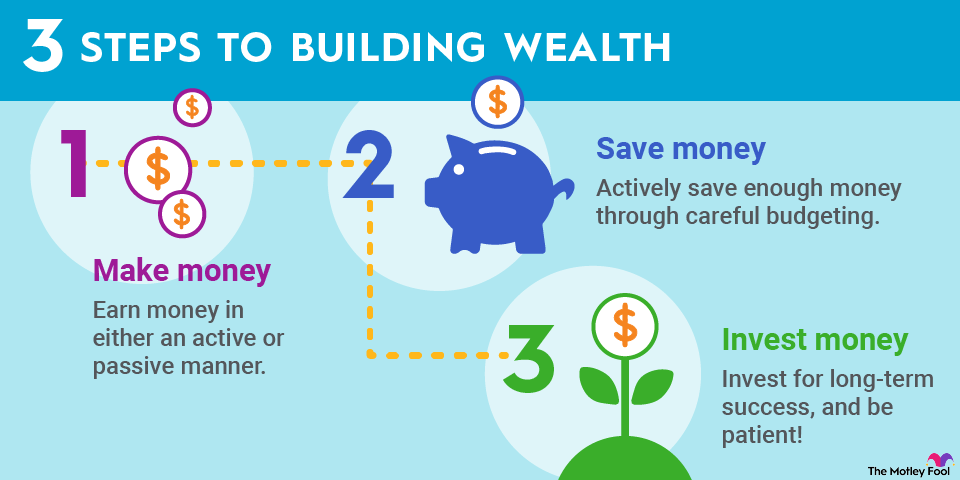

Image courtesy of www.fool.com via Google Images

Market Fluctuations: The stock market can be volatile, with prices fluctuating based on various factors such as economic conditions, company performance, and investor sentiment. It is normal for your investments to experience ups and downs.

Long-Term Perspective: Investing is a long-term game. While short-term market fluctuations can be concerning, it is essential to focus on your long-term investment goals and stay committed to your investment plan.

Risk vs. Reward: Higher returns typically come with higher risks. It is important to balance the potential rewards of an investment with the risks involved and make informed decisions based on your risk tolerance.

Seeking Professional Advice

If you are unsure about how to start investing or need guidance on building a solid investment plan, consider seeking professional advice from a financial advisor. A financial advisor can help assess your financial situation, set realistic investment goals, and create a tailored investment strategy that aligns with your needs and risk tolerance.

Remember, investing is a journey that requires patience, discipline, and a long-term perspective. By understanding the basics of investing and creating a solid investment plan, you can take control of your financial future and work towards building wealth over time.