10 Proven Ways to Boost Your Online Business Sales

June 21, 2024Discover the top 10 tried-and-true strategies to skyrocket your online business sales and leave your competition in the dust!

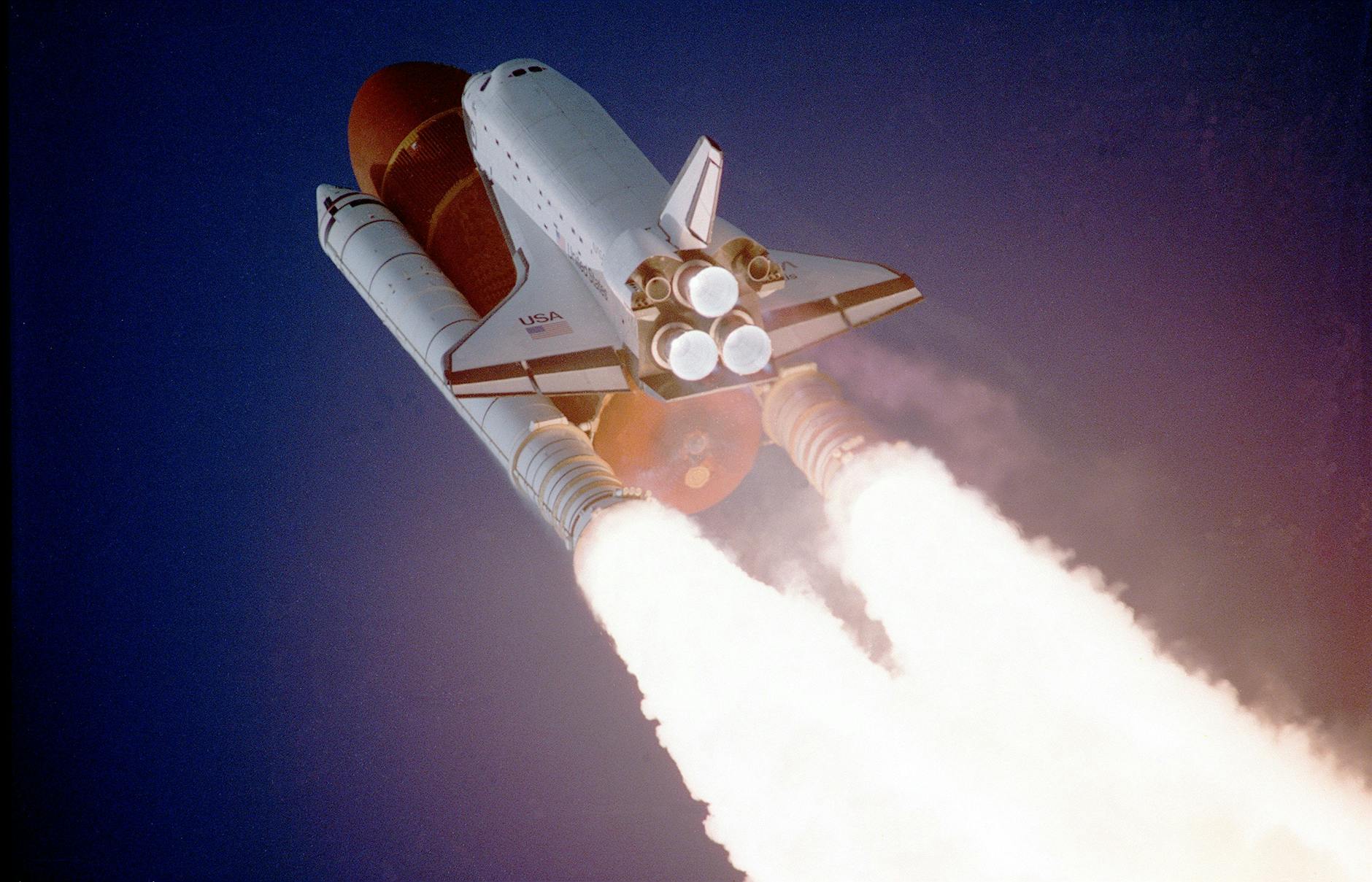

Image courtesy of Pixabay via Pexels

Table of Contents

In the world of business, financial planning is crucial, especially for small business owners who often juggle multiple responsibilities. Managing finances effectively can mean the difference between success and failure. In this blog post, we will explore some key financial planning strategies tailored for small business owners to help them navigate the challenges and achieve their goals.

Understanding Your Business Finances

One of the foundational aspects of financial planning for small business owners is understanding their business finances. This includes tracking income and expenses, creating a budget, and managing cash flow effectively. By keeping a close eye on these key financial metrics, business owners can make informed decisions and ensure the financial health of their enterprise.

Setting Financial Goals

Setting clear financial goals is essential for small business owners to stay focused and motivated. Whether it’s short-term objectives like increasing revenue or long-term goals like expanding operations, having a roadmap in place can guide business owners towards success. Using the SMART goal-setting framework (Specific, Measurable, Achievable, Relevant, Time-bound) can help ensure that financial goals are well-defined and attainable.

Investing in Your Business

Investing in the growth and development of your business is a key component of financial planning. Reinvesting profits back into the business can fuel expansion and innovation. Additionally, allocating funds for marketing initiatives, upgrading technology, and improving infrastructure can enhance the overall competitiveness and sustainability of the business.

Risk Management and Insurance

Assessing risks and vulnerabilities is an important aspect of financial planning for small business owners. Identifying potential threats to the business, such as market fluctuations or natural disasters, allows business owners to develop contingency plans to mitigate risk. Investing in business insurance can provide a safety net in case of unforeseen events, protecting the business’s financial stability.

Seeking Professional Help

While small business owners often wear many hats, seeking professional help in financial planning can be instrumental in driving business success. Hiring a financial advisor or accountant can provide expert guidance on managing finances, tax planning, and investment strategies. Choosing the right financial professional who understands the unique needs of your business can help optimize financial strategies and ensure long-term growth.

Conclusion

Financial planning is a critical component of running a successful small business. By understanding your business finances, setting clear financial goals, investing strategically, managing risks, and seeking professional help, small business owners can navigate the complexities of financial management and drive their businesses towards growth and profitability. Remember, proactive financial planning is key to securing the financial future of your business.