10 Proven Strategies to Boost Business Sales in 2021

May 30, 2024Discover the top 10 proven tactics to skyrocket your business sales in 2021 and leave your competition in the dust.

Image courtesy of Kindel Media via Pexels

Table of Contents

Managing finances is a crucial aspect of running a successful business. It helps you make informed decisions, plan for the future, and ensure the financial health of your company. In this blog post, we will discuss some key strategies to help you effectively manage finance in your business.

Set financial goals

Setting financial goals is the first step in effectively managing finance in your business. Whether you are looking to increase revenue, reduce expenses, or improve cash flow, it is important to have clear and measurable goals. By setting specific, achievable, relevant, and time-bound (SMART) goals, you can stay focused and motivated to achieve financial success.

Create a budget

Creating a budget is essential for managing finances in your business. A budget helps you track your income and expenses, identify areas where costs can be reduced, and plan for future investments. Include all sources of revenue and expenses in your budget, and regularly monitor and update it to ensure financial stability.

Track expenses

Tracking expenses is another important aspect of effective financial management. Implement a system to record all business expenses, categorize them to easily identify areas where costs can be reduced, and regularly review your expenses. By keeping a close eye on your expenses, you can make informed decisions about where to cut costs and improve your bottom line.

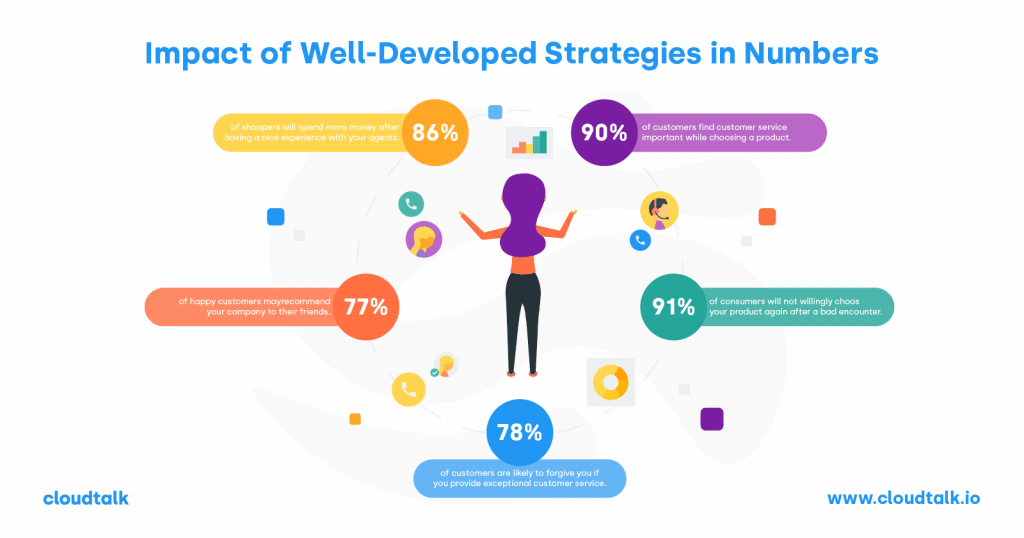

Image courtesy of www.cloudtalk.io via Google Images

Manage cash flow

Cash flow management is critical for the financial health of your business. Understand the importance of maintaining a positive cash flow and develop strategies to improve it. This may include timely invoicing, efficient collection of receivables, and careful monitoring of expenses. Utilize tools and software to forecast your cash flow and plan for any potential shortages.

Seek professional advice

Consider seeking professional advice to help you effectively manage your finances. A financial advisor or accountant can provide valuable insights into financial planning, tax strategies, and investment opportunities. Consult with experts to get personalized advice for your business and take advantage of resources such as workshops and online courses to improve your financial literacy.

Image courtesy of www.cloudtalk.io via Google Images

Conclusion

Effective financial management is essential for the success of your business. By setting clear financial goals, creating a budget, tracking expenses, managing cash flow, and seeking professional advice, you can ensure the financial health and stability of your company. Implement these strategies in your business to effectively manage finance and drive long-term growth and success.