10 Innovative Business Strategies to Take Your Company to the Next Level

June 7, 2024Unlock the secrets of success with these 10 groundbreaking business strategies guaranteed to propel your company to new heights.

Image courtesy of Skitterphoto via Pexels

Table of Contents

Managing the finances of your business is a crucial aspect of ensuring its long-term success and growth. Without proper financial management, even the most innovative business strategies can fall flat. In this guide, we will walk you through a step-by-step approach to successfully managing your business finances and setting your company up for future success.

Assess Your Current Financial Situation

Before you can effectively manage your business finances, you need to have a clear understanding of your current financial situation. Start by conducting a thorough financial audit of your business. Evaluate your cash flow, profit margins, and expenses to identify any areas of improvement or potential financial risks.

Create a Budget and Financial Plan

Once you have a clear picture of your current financial situation, it’s time to create a budget and financial plan for your business. Develop a realistic budget that outlines your income and expenses, and set financial goals and objectives for the future. Allocate funds for various expenses, including operating costs, investments, and savings to ensure you are staying on track financially.

Monitor and Track Your Finances

Implement a system for tracking your business’s income and expenses on a regular basis. Utilize financial reports to monitor your financial health and make informed decisions about your budget and financial plan. By staying on top of your finances, you can identify any potential issues early on and make adjustments as needed.

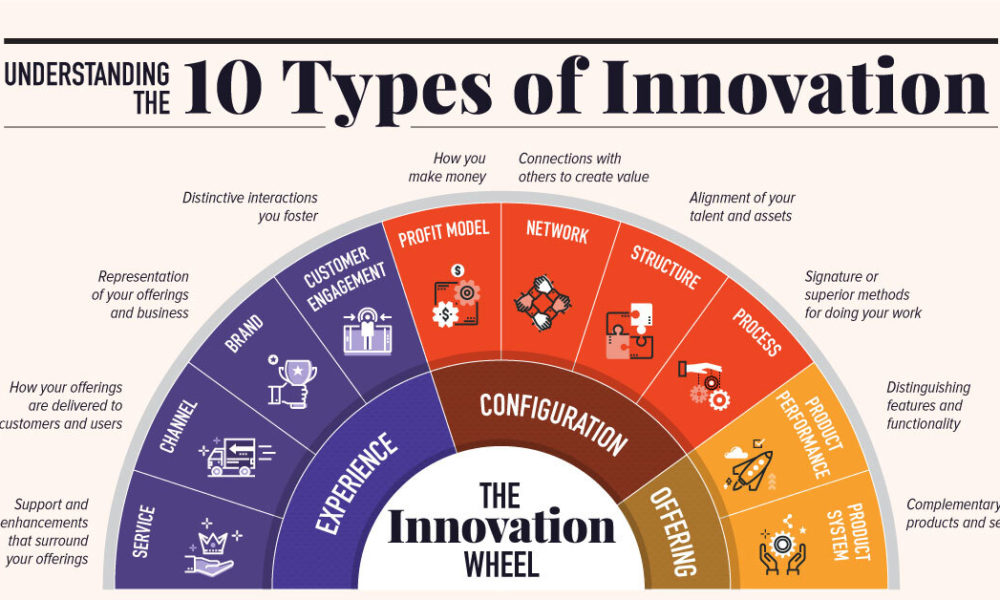

Image courtesy of www.visualcapitalist.com via Google Images

Control Costs and Maximize Revenue

To improve your financial situation, consider ways to control costs and maximize revenue. Look for opportunities to reduce overhead costs and streamline your operations. Improving your cash flow management and invoice processes can also help boost your bottom line. Additionally, explore new revenue streams and opportunities for growth to increase your company’s profitability.

Seek Professional Advice and Resources

Consider seeking the guidance of a financial advisor or accountant to help you navigate the complexities of business finance. They can provide valuable insights and advice to help you make informed financial decisions. Stay informed about financial trends and regulations that may impact your business, and utilize financial management tools and resources to simplify the process.

Image courtesy of presentationgeeks.com via Google Images

Conclusion

Successfully managing your business finances is essential for the long-term success and growth of your company. By assessing your current financial situation, creating a budget and financial plan, monitoring and tracking your finances, controlling costs, maximizing revenue, and seeking professional advice, you can set your business up for future success. Take control of your finances and make smart financial decisions to ensure your company thrives in the years to come.