10 Business Trends to Watch in 2021

June 4, 2024Discover the top 10 business trends of 2021 that are reshaping industries and revolutionizing the way companies operate.

Image courtesy of Arnesh Yadram via Pexels

Table of Contents

Managing business finances effectively is a critical aspect of running a successful business. It involves setting financial goals, tracking expenses, monitoring cash flow, managing debt, and seeking professional help. In this blog post, we will provide you with a comprehensive guide on how to manage your business finances effectively.

Set financial goals

Setting financial goals is the first step in managing business finances effectively. It is important to identify both short-term and long-term financial goals for your business. Short-term goals may include increasing revenue or reducing expenses, while long-term goals could involve expanding into new markets or launching a new product.

Once you have identified your financial goals, it is essential to establish a budget to help you achieve them. A budget will provide you with a roadmap for your financial activities and help you track your progress towards your goals.

Track expenses

Tracking expenses is crucial for managing business finances effectively. Keeping detailed records of all business expenses will help you understand where your money is going and identify areas where you can cut costs. It is recommended to use accounting software or tools to track expenses in real-time, making it easier to analyze your financial data and make informed decisions.

Monitor cash flow

Monitoring cash flow is essential for the financial health of your business. Regularly reviewing cash flow statements will allow you to track incoming and outgoing funds, identify any cash flow issues, and take proactive steps to address them. By understanding your cash flow, you can ensure that your business has enough liquidity to meet its financial obligations.

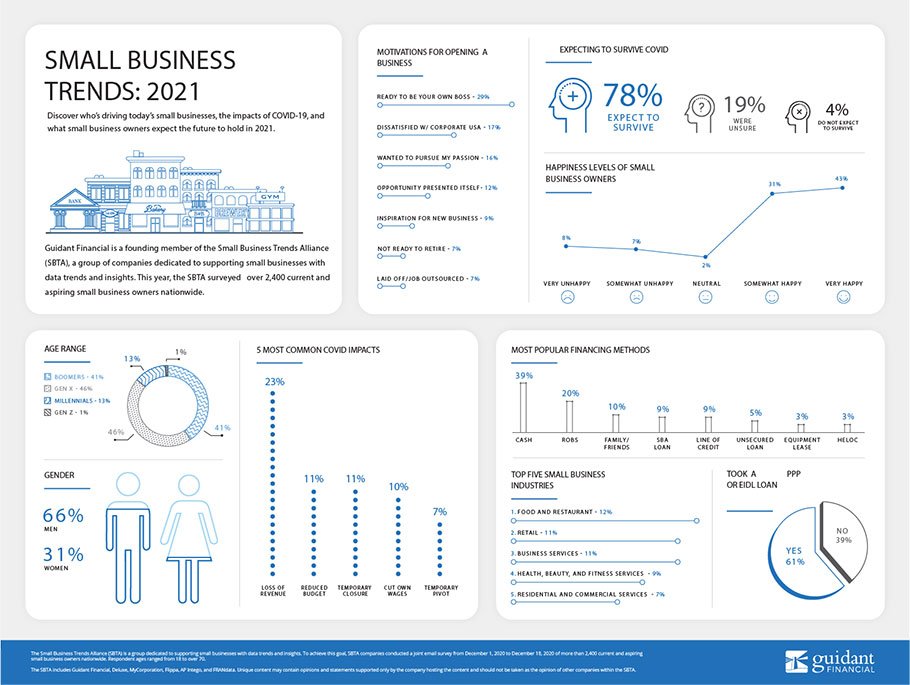

Image courtesy of www.guidantfinancial.com via Google Images

If you notice any cash flow challenges, consider implementing strategies such as invoice financing or negotiating payment terms with suppliers to improve your cash flow position.

Manage debt

Managing debt is another critical aspect of effective financial management. Create a plan to pay off outstanding debts and prioritize high-interest debts first. Consider refinancing options or negotiating with creditors to reduce interest rates or extend payment terms. By effectively managing your debt, you can improve your financial position and reduce financial stress.

Seek professional help

Seeking professional help can be beneficial for managing your business finances effectively. Consider hiring a financial advisor or accountant to provide expert guidance on financial matters. A professional can help you develop a financial strategy, analyze your financial data, and make informed decisions to improve your financial performance.

Additionally, attending financial management workshops or webinars can enhance your financial literacy and provide you with valuable insights into managing business finances effectively.

Conclusion

Effectively managing business finances is essential for the success of any business. By setting financial goals, tracking expenses, monitoring cash flow, managing debt, and seeking professional help, business owners can ensure the long-term financial health of their company. Implementing these strategies will help you make informed financial decisions, improve cash flow, and achieve your financial goals.

Remember, managing business finances is an ongoing process that requires careful planning, monitoring, and adjustment. By following the tips outlined in this blog post, you can take control of your business finances and set your company up for long-term success.