10 Business Tips for Success in Today’s Market

May 30, 2024Unlock the secrets to thriving in today’s competitive market with these essential business tips for success. Don’t miss out!

Image courtesy of Valentin Antonucci via Pexels

Table of Contents

Financial planning is a crucial aspect of running a successful business. Whether you are a small startup or a large corporation, having a solid financial plan in place can help you navigate the ups and downs of the market and ensure long-term sustainability. In this blog post, we will explore the importance of financial planning for businesses and provide valuable tips on how to develop an effective financial plan for your business.

Understanding the Basics of Financial Planning

Financial planning is the process of setting financial goals, creating a budget, and managing cash flow to achieve those goals. The primary objectives of financial planning include ensuring adequate liquidity, profitability, and solvency for the business. By having a clear understanding of your financial status and setting realistic goals, you can make informed decisions that will drive the growth and success of your business.

Benefits of Financial Planning for Businesses

There are numerous benefits that come with proper financial planning for businesses. One of the key advantages is improved decision-making. When you have a well-thought-out financial plan in place, you can make strategic decisions that align with your long-term goals and objectives. Financial planning also helps businesses manage risks more effectively by identifying potential challenges and developing contingency plans to mitigate them.

Furthermore, financial planning enables businesses to respond proactively to economic uncertainties and market changes. By monitoring key financial indicators and adjusting your plan as needed, you can adapt to shifting market conditions and seize new opportunities as they arise.

Steps to Develop a Financial Plan

Developing a financial plan for your business involves several key steps. The first step is to assess your current financial status, including your assets, liabilities, and cash flow. This will help you understand where your business stands financially and identify areas for improvement.

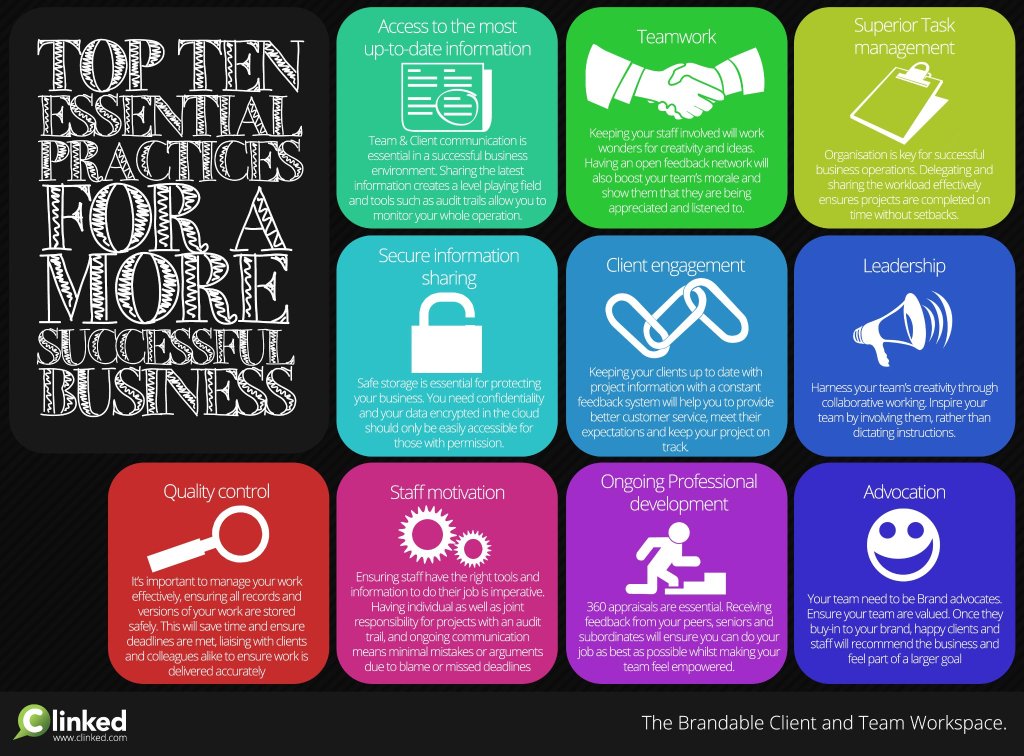

Image courtesy of blog.clinked.com via Google Images

Next, you should set clear financial goals for your business. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Whether your goal is to increase revenue, reduce expenses, or improve profitability, having a clear target in mind will guide your financial planning efforts.

Once you have defined your financial goals, you can create a budget that outlines your projected income and expenses. A budget serves as a roadmap for your financial activities and helps you allocate resources effectively to achieve your goals. Be sure to review and adjust your budget regularly to ensure that you stay on track.

Tools and Resources for Financial Planning

There are various tools and resources available to businesses to help them with financial planning. Accounting software, such as QuickBooks or Xero, can streamline your financial processes and provide insights into your business’s financial health. Financial calculators can help you analyze different scenarios and make informed decisions based on quantitative data.

Additionally, consulting with a professional financial advisor can provide valuable expertise and guidance on complex financial matters. An experienced advisor can help you develop a comprehensive financial plan tailored to your business’s specific needs and goals. By leveraging these tools and resources, you can enhance your financial planning capabilities and set your business up for success.

Conclusion

Effective financial planning is essential for businesses looking to achieve long-term success and sustainability in today’s competitive market. By understanding the basics of financial planning, recognizing the benefits it can bring, and following the steps outlined in this blog post, you can develop a solid financial plan that will guide your business towards its goals.

Remember to regularly review and adjust your financial plan as needed to ensure that it remains relevant and effective. By prioritizing financial planning as a key component of your business strategy, you can position your business for growth and prosperity in the ever-changing business landscape.